Money is one of the biggest sources of contention for many couples today. And with all of the economic uncertainty in the world, it’s a great time to start discussing any financial issues with your spouse. All couples should cover various financial topics throughout their marriage – you can’t be scared of the money talk.

In a perfect world, every couple would be on the same page when it comes to their personal finances. However, it’s quite rare that couples do not have at least some issues in this area. The best way to combat potential issues is to have plenty of open communication. Open communication is the best way to avoid major arguments in the future.

Here are some of the most important areas to discuss with your spouse about your finances.

Debt Management

Perhaps the biggest issue that many couples have is their debt. High levels of debt can cause a lot of stress in a marriage. With the cost of college increasing almost every year, many students graduate with high levels of debt. If two people get married after graduating college, there will likely be student loans to pay down.

You and your partner need to know how much debt you’re carrying. It’s a good idea to get a current credit report you can review together.

If couples can get on the same page financially early in their marriage, they will have a much easier time building wealth. As a general rule, it’s a good idea to pay down as much debt as possible. High levels of student loan debt make it difficult to buy a house or make other investments.

Bank Accounts

According to CNBC, less than 50% of married couples manage their finances through joint accounts. It’s important to note there’s no universally correct approach to this – what works best is largely dependent on the couple’s individual needs and circumstances.

Many couples opt for a hybrid approach, maintaining both a joint account and individual accounts. This setup allows you to handle shared expenses, like bills, from the joint account, while keeping certain financial matters separate.

A common practice? Each of you deposits your pay into an individual account. Then, based on respective incomes, you transfer a predetermined percentage into the joint account every month. This way, you both effectively manage the collective expenses while still maintaining some degree of financial autonomy.

Savings and Retirement

Saving money isn’t just about stashing away whatever you have left at the end of the month. It’s a strategic process that needs to be thought out and planned in advance with your partner. Unfortunately, too many couples don’t put enough time into this crucial step.

But let’s clear up a common misconception: budgeting doesn’t mean you have to give up all the fun stuff. It’s not about restricting yourself – it’s about planning wisely.

Think of your budget as a roadmap for spending. You can still enjoy life, make purchases, and indulge a little. The key is to have a realistic plan that allows you to maintain your lifestyle while also setting aside a specific amount for your future.

Now, if you’re wondering how much to save, online retirement-savings calculators can be a big help. They can help you set a goal and figure out how much you need to save each month to reach that target within your desired timeframe.

Creating a budget isn’t a one-person job either. It’s a team effort where both partners’ ideas and goals should be considered. Together, you’ll determine your priorities, make necessary compromises, and decide how much money will go towards your savings or retirement plan. Remember, a budget isn’t set in stone – it’s a living, breathing plan that can (and should) be adjusted as your circumstances change.

So, grab a cup of coffee, sit down with your partner, and start crafting your budget. It might not be the most exciting date night, but trust me, your future selves will thank you for it!

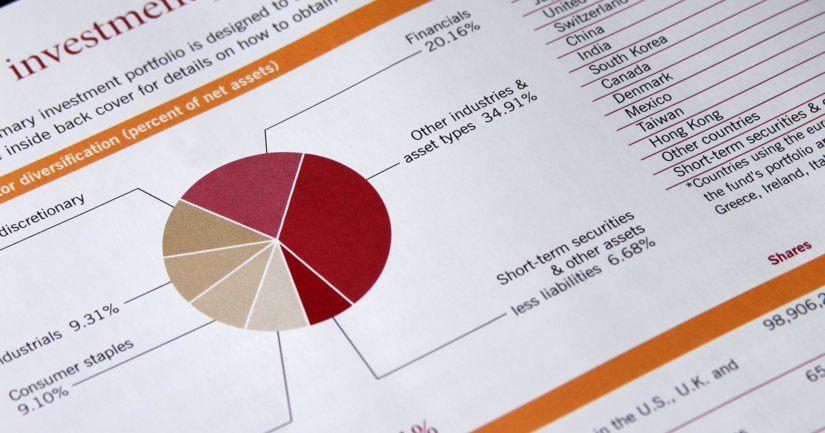

Investment Portfolio

Without a doubt, investing is the best way to build wealth over time. Simply saving money every month is not going to help you reach your financial goals. Some people are naturally good at putting money away every month in their investments. However, other people would rather use that money today for other expenses.

One of the most important decisions any couple has to make is how much money to invest every month. The earlier you start investing together, the easier it will be to build wealth over a long period. Canada has plenty of retirement investing options for couples who conduct thorough research. Not only will you save money on taxes, but these retirement accounts are easy to use and understand.

Buying a Home

For most couples, buying a home is the largest financial decision they’ll ever make. Some people want to buy a home in a rural area, and other people would rather rent in the city. It’s a good idea to understand where your partner is coming from before getting married. This could be a major source of contention in your marriage if you’re not aligned on this subject.

Once you are on the same page with the type of home you want to buy, you’ll want to make a plan for how the mortgage and bills will be paid. Will the payments come out of a joint account? If one of you makes more money than the other, will that be accounted for when splitting costs? These are the type of questions you’ll want to ask each other so you both know what is expected.

Every marriage has various struggles to work through. For the vast majority of people, their finances are a source of regular arguments. If you can get organized and focused on your finances, you will be able to make a huge positive change in your marriage.

Having success in your finances is all about making a plan and sticking with it over time. Buying a home is just one aspect of this process. Start working with your spouse today on developing a financial plan for your future and have that important money talk. You will quickly see an improvement in your overall happiness and marriage.

0 Comments